11 Best Dunning Management Software Tools of 2026

Failed payments cost subscription businesses $118.5 billion annually. Dunning management software recovers this lost revenue through smart retry logic, personalized customer outreach, and automated workflows that reduce involuntary churn while preserving customer relationships.

Quick Summary

Failed payments cost subscription businesses $118.5 billion annually. Dunning management software recovers this lost revenue through smart retry logic, personalized customer outreach, and automated workflows that reduce involuntary churn while preserving customer relationships.

Here are our top three picks:

Why Dunning Management Software Matters

Failed payments are one of the most underestimated revenue losses in subscription and SaaS businesses. According to sources, they account for $118.5 billion in lost revenue every year globally, due to expired cards, bank declines, and failed retries.

For subscription businesses, this issue manifests as involuntary churn, resulting in considerable financial losses across the industry. Even high-growth companies with strong acquisition funnels lose meaningful MRR every month if payment recovery isn't managed properly.

This is where dunning management software tools make a significant difference.

These tools combine smart features and customizable strategies to recover revenue that would otherwise be lost.

In this article, we'll walk through some of the best dunning management software tools for recurring-revenue businesses, highlighting each platform's key features, pros and cons, rating and pricing.

11 Best Dunning Management Software Tools

We've put together a list of the most favored dunning management software tools for your consideration:

1. Lunos AI

Best For: B2B companies of all sizes that issue invoices and want an AI coworker to handle the full receivables workflow, from follow-ups to customer replies.

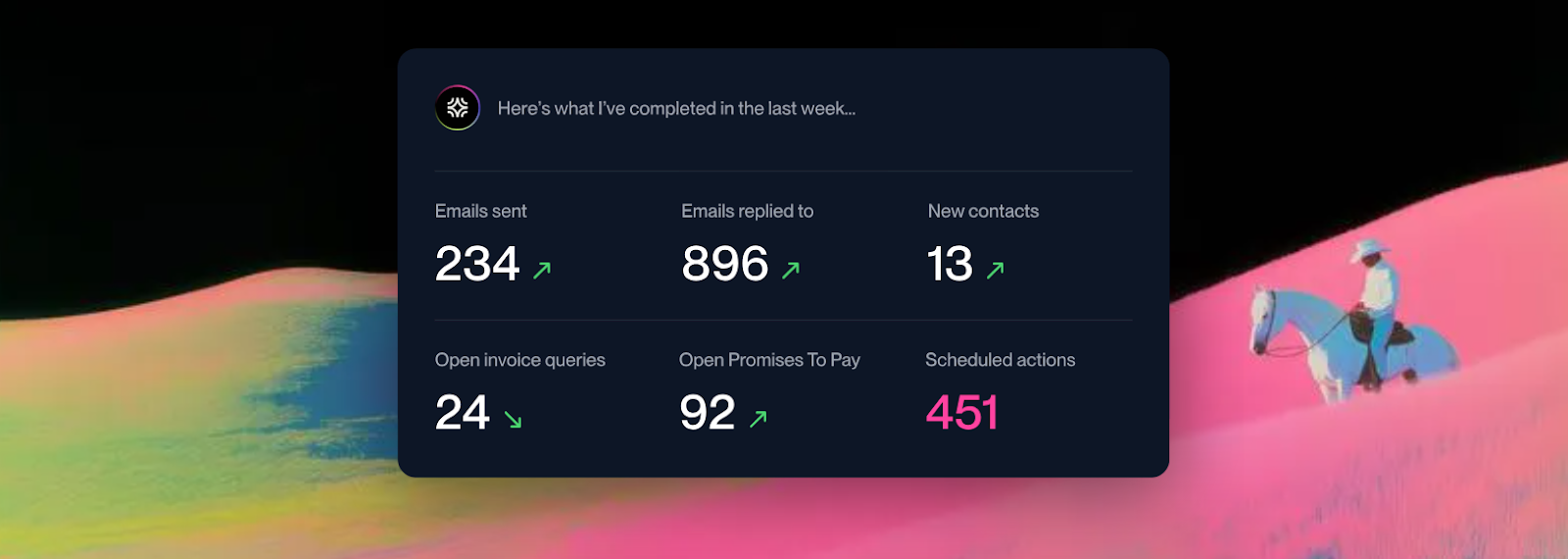

Source: Lunos AI

Lunos AI is an AI coworker for accounts receivable that handles customer follow-ups and collections like a human team member. Unlike traditional dunning tools that only send reminder emails, Lunos reads customer responses, understands payment promises, identifies disputes, and adapts follow-ups based on context and relationship history.

While most dunning tools focus narrowly on failed card payments in subscription businesses, Lunos is built for the broader complexity of B2B receivables. It manages invoice-based workflows where payments involve negotiation, delays, and nuance. Finance teams stay in control through three autonomy modes (Monitor, Suggest, and Act) and can collaborate directly in Slack rather than learning new software.

Customers have seen up to 61% reduction in receivables balances within weeks of implementation..

Key Features

- Two-way conversational intelligence that reads replies and understands customer intent

- Adaptive follow-up management that tracks payment promises and adjusts timing automatically

- Multi-system integration connecting ERPs (e.g. QuickBooks, NetSuite), CRMs (Salesforce, HubSpot), and payment processors

- Slack-native workflow for approvals, daily summaries, and team collaboration

- Three autonomy modes (Monitor, Suggest, Act) that let teams control AI independence

- Exception routing that surfaces disputes and complex situations requiring human attention

- Complete audit trail for compliance and real-time cash forecasting

Pros

- Handles full conversation cycle, not just outbound reminders

- Reduces AR workload by approximately 75% while preserving customer relationships

- Teams can scale invoice volume 5-10× without adding headcount

- Personalized communication at scale instead of generic automated emails

- Real-time visibility into payment promises improves cash forecasting accuracy

Cons

- Pricing details are not publicly displayed

- Requires integration with finance systems to unlock full value

G2 Rating

N/A

Pricing

Lunos offers a free start option and custom pricing based on your business's volume and usage.

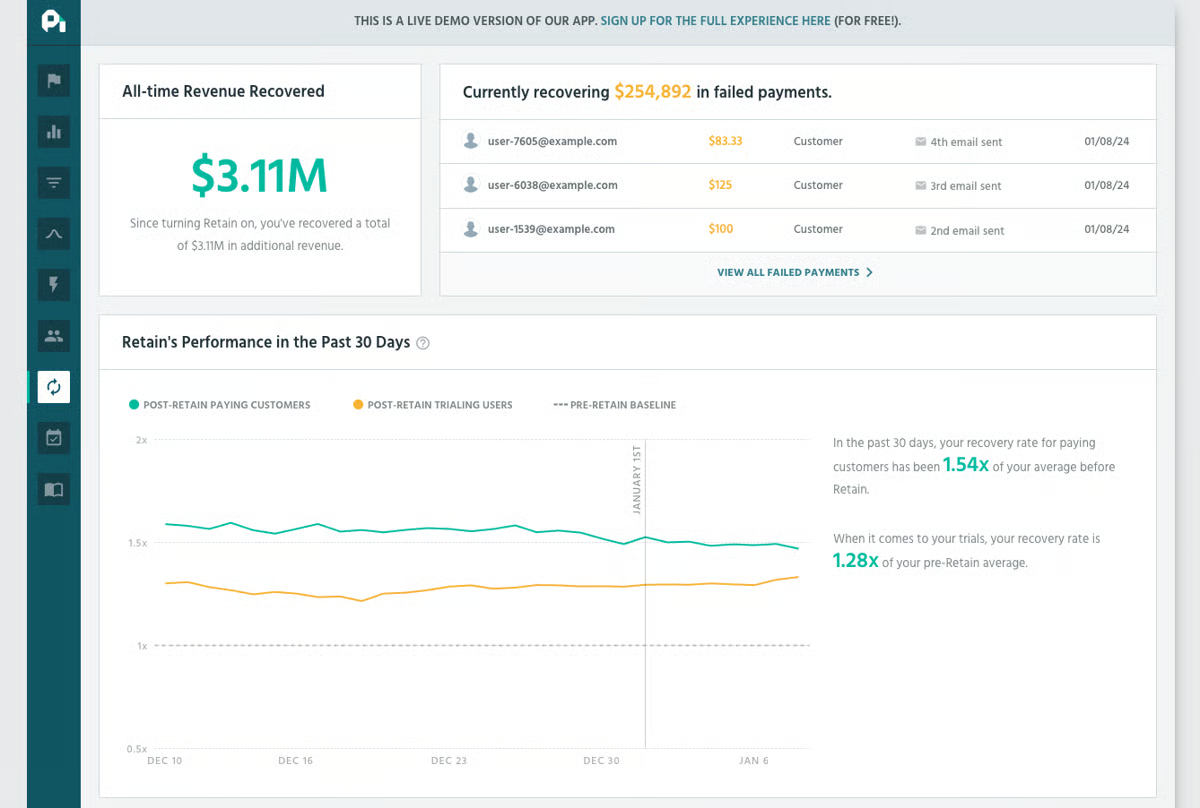

2. Paddle Retain

Best For: SaaS, apps, and digital product businesses that want enterprise-grade dunning and cancellation flows integrated with their billing system.

Paddle Retain (formerly ProfitWell Retain) is Paddle's native dunning and customer retention solution. Its features are geared toward preventing failed payments, reducing churn through personalized offers, and gathering insights into cancellations. All of this is powered by billions of data points across Paddle's network.

The tool integrates with all major billing and subscription providers on the market, which is great for teams that require an all-in-one approach rather than stitching together multiple tools.

Source: G2

Key Features

- Fully automated dunning to recover failed payments caused by expired cards

- Cross-platform retention across SaaS, apps, and digital products

- Proactive retry logic with high recovery rates

- Automated cancellation flows that present personalized retention offers

- SOC2 certified and GDPR compliant

Pros

- Easy-to-use interface, even for non-technical users

- Simple onboarding and intuitive dashboard

- Time-saving automated custom emails

- Broad payment method coverage

Cons

- Poor support service according to some users

- Pricing can be expensive, especially with additional fees

G2 Rating

⭐ 4.8 out of 5

Pricing

Paddle Retain follows a performance-based model for larger companies and a flat-fee model for smaller ones (starting at $500/month).

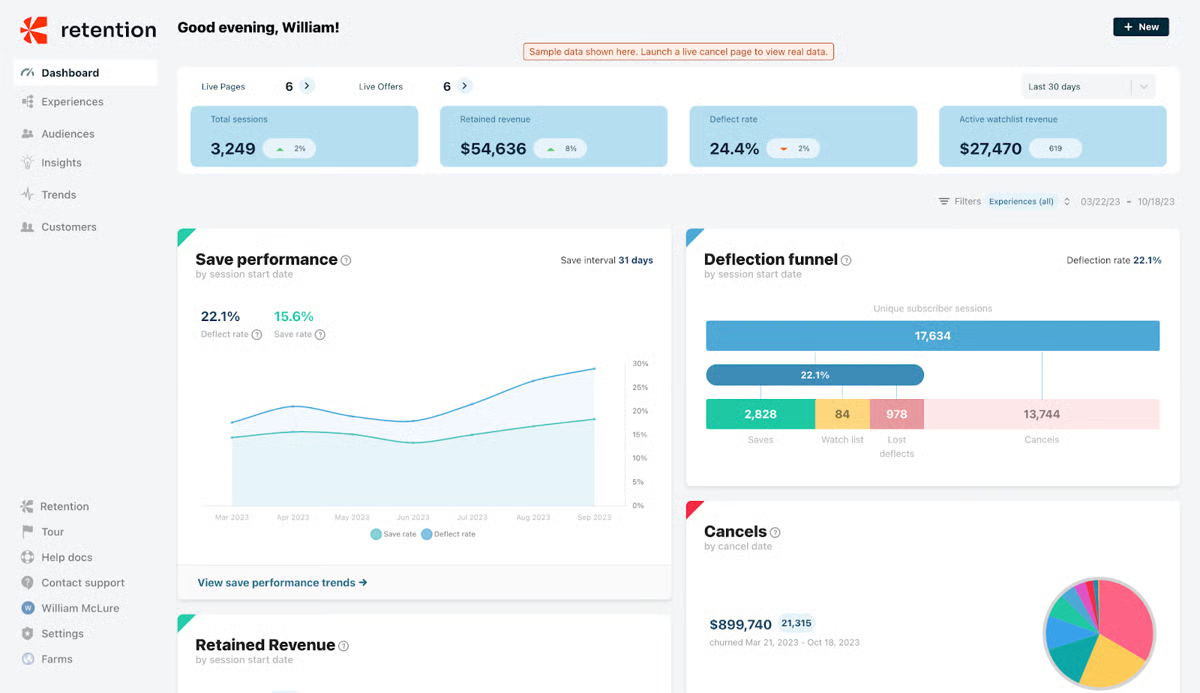

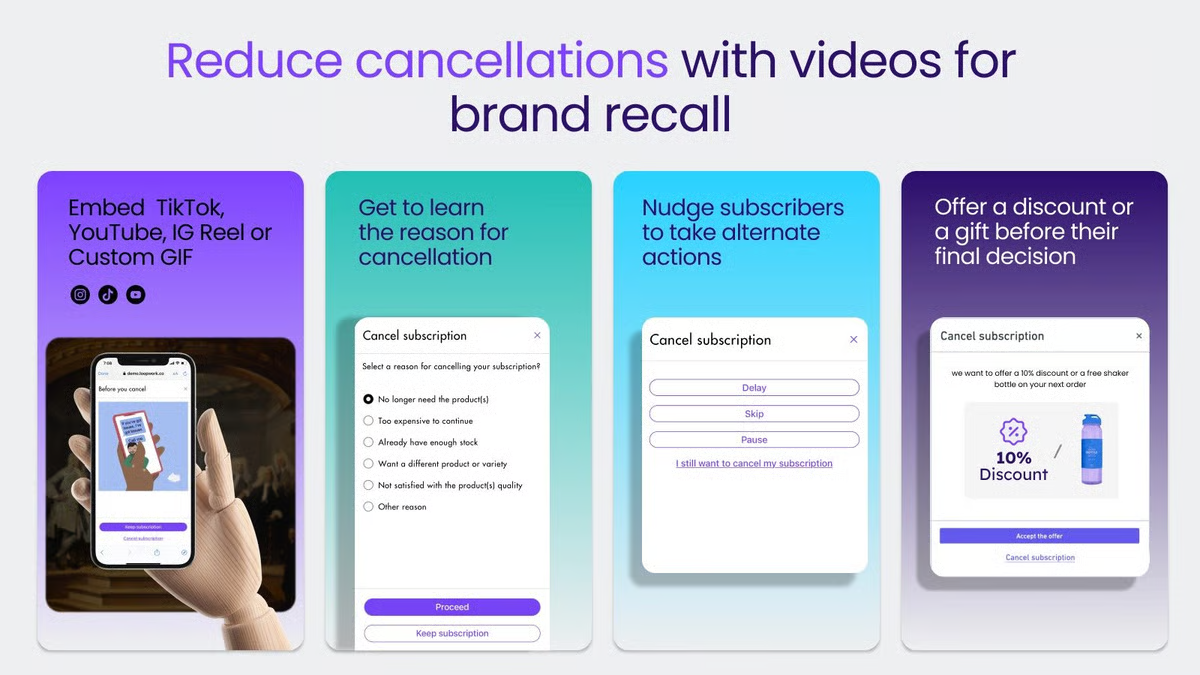

3. Chargebee Retention

Best For: Subscription businesses that want built-in, automated dunning without managing a separate recovery platform.

Source: G2

Chargebee Retention helps digital product managers reduce involuntary churn with personalized offers, retention workflows, and specialized insights that increase Lifetime Value (LTV).

Since it's natively integrated with Chargebee's platform, Retention works best for teams already using Chargebee and looking for native dunning rather than a standalone recovery tool.

Key Features

- Personalized cancellation experiences (customized messaging, offers, and surveys)

- Dynamic targeting and segmentation based on attributes like LTV and subscription value

- Easy-to-read dashboards

- Real-time visibility into offers

- Native integration with billing platforms like Chargebee, Recurly, Stripe, and more

Pros

- Simplifies complex problems for users

- Clear visibility into why customers pause or cancel subscriptions

- Personalized retention offers based on customer behavior

- Helps teams actively test and iterate on retention strategies

- Easy to set up with a clean, intuitive interface

- Strong support team and helpful customer success guidance

Cons

- Pricing can become expensive at scale, especially with high cancellation volumes

- Managing offers for tests can get tricky, though it's manageable if you keep it simple

- Creating and managing multiple offers can feel clunky or hard to organize

G2 Rating

⭐ 4.3 out of 5

Pricing

Here's an overview of Chargebee Retention pricing plans:

- Performance Plan: Starts at $250 per 50-149 sessions per month

- Enterprise Plan: Quote based on your business needs

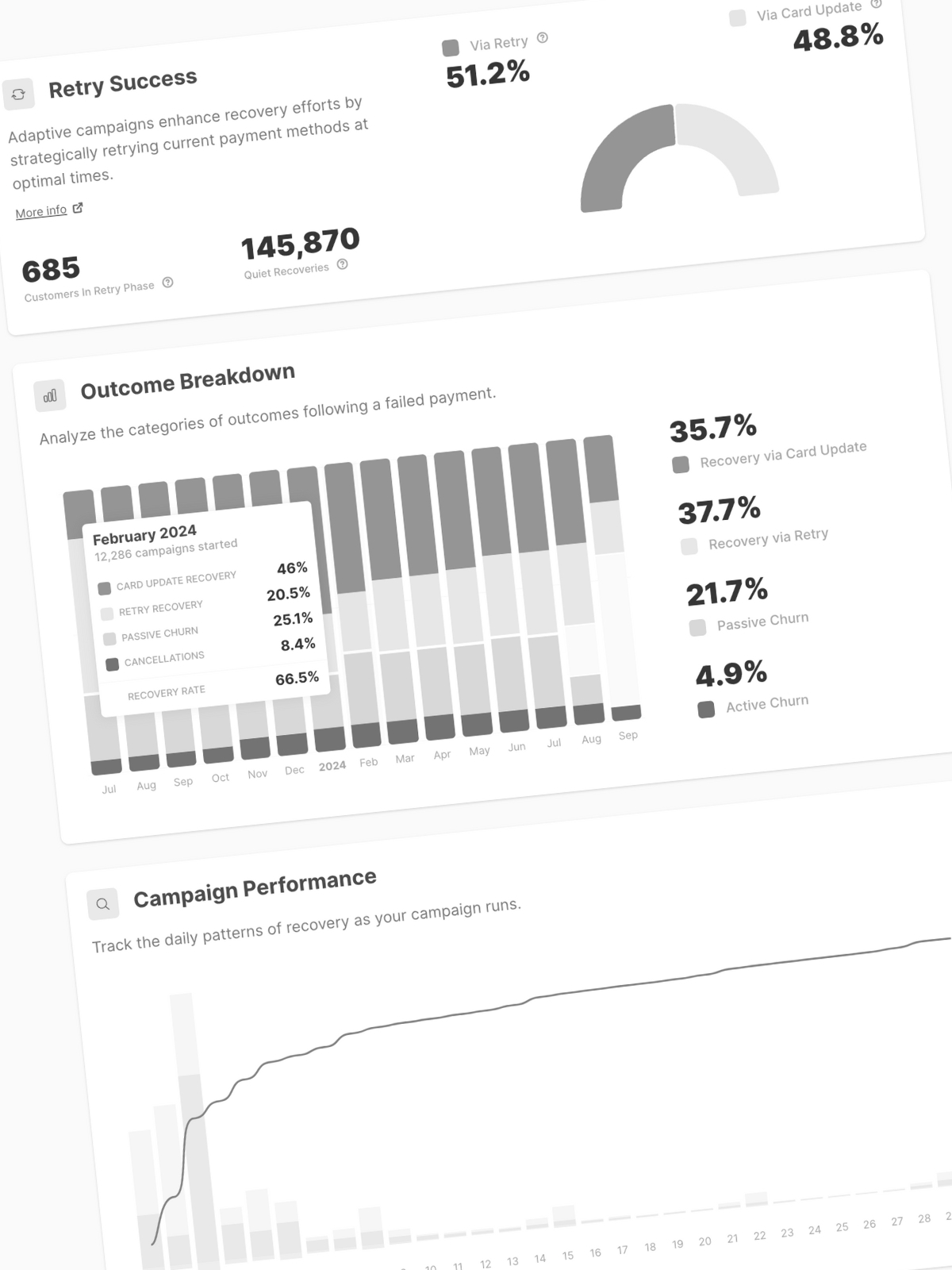

4. Churn Buster

Best For: Subscription businesses (especially eCommerce and B2B SaaS) that need to reduce both passive and active churn.

Source: Churn Buster

Churn Buster is a specialized subscription retention platform focused on payment-related churn (passive churn) and cancellation-driven churn (active churn).

With over 10 years of proven eCommerce and B2B/SaaS expertise, it's designed for teams that want to go beyond basic retry logic and treat dunning and cancellation flows as strategic revenue levers.

Key Features

- Most brands see 10%+ recovery improvements right away

- Advanced retry logic based on millions of recovery data points

- Personalized experiences for subscribers who decide to cancel

- Insights into cancellation reasons and other important retention metrics

- Integrations with Stripe, Shopify, ReCharge, Loop, Skio, and more

Pros

- Clean, insightful UI and dashboard

- Easy and fast implementation with low setup effort

- Seamless integration with Stripe

- Hands-off automation using proven best practices

- More effective and smarter than manual recovery emails

Cons

- Cost might be a concern for smaller teams already recovering revenue manually

G2 Rating

⭐ 4.3 out of 5

Pricing

Churn Buster's pricing for a complete retention solution starts from $249. For businesses that only need dunning or cancellation flow services, pricing is available by booking a call with the Churn Buster team.

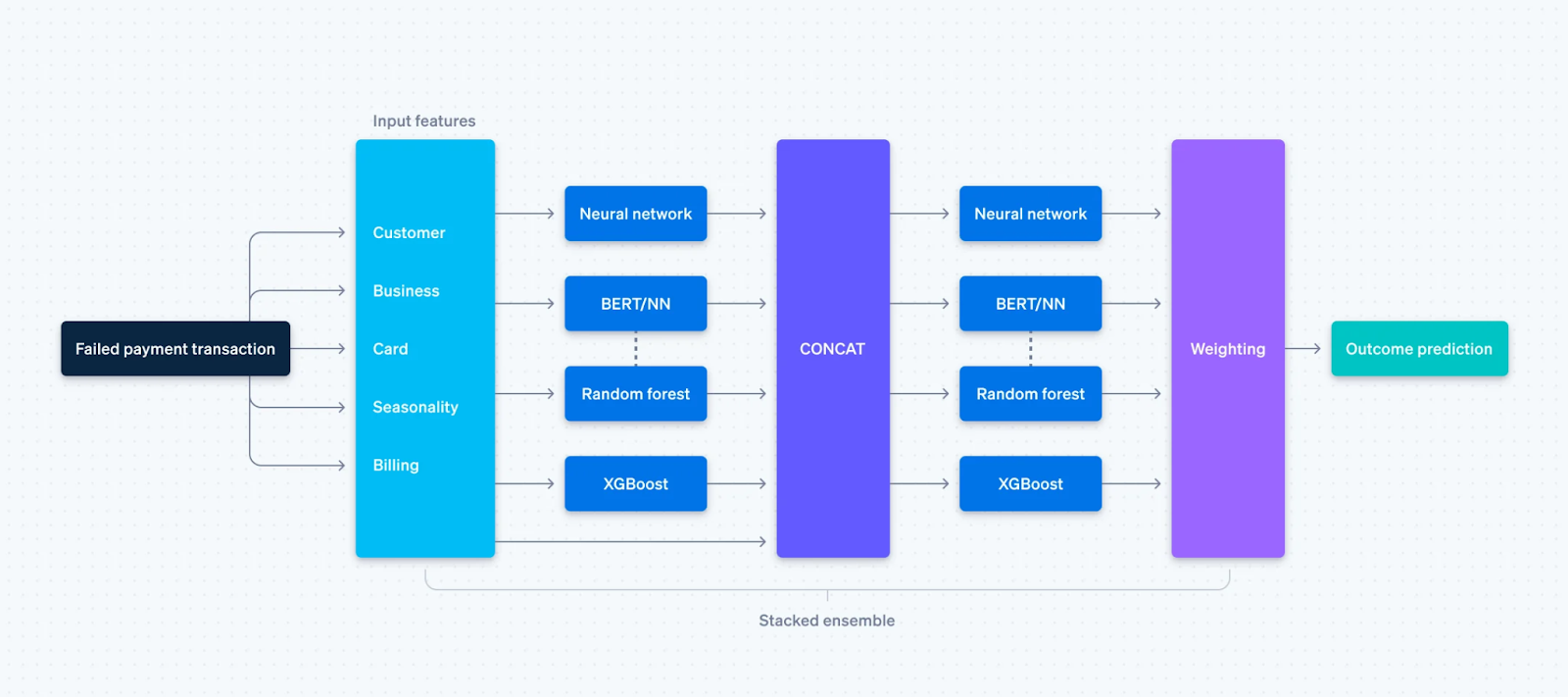

5. Revaly (Formerly FlexPay)

Best For: E-commerce and subscription businesses looking for advanced, AI-driven payment recovery with a focus on reducing churn.

Source: Revaly

Revaly is a payment performance platform designed to reduce involuntary churn by improving approval rates and recovering failed payments across the entire billing lifecycle.

The platform's focus doesn't lie just on retries or reminder emails. Revaly works deeper in the payment stack, using issuer signals and network intelligence to ensure legitimate transactions go through in the first place.

Key Features

- Uses machine learning to optimize payments across the entire billing lifecycle

- AI-powered recovery

- Recovers failed payments while protecting customer trust

- Integrates with over 100 billing and payment processing systems, including Stripe, Chargebee, and Zuora

- Reduces involuntary churn by focusing on recovery strategies

Pros

- Effective technology that improves declining payment recovery rates

- Clear measurement of impact on recovered revenue

- Viewed as a strong partner rather than just a tool

- Collaboration and partnership approach appreciated by customers

Cons

There are currently very few negative reviews about Revaly. Based on older customer feedback, limitations on process implementation were noted.

G2 Rating

⭐ 5 out of 5

Pricing

Pricing is customized based on your business needs. The model includes a platform fee plus a performance-based component based on your revenue outcomes.

6. Baremetrics Recover

Best For: Subscription businesses (especially SaaS) that need to minimize involuntary churn by automating dunning through emails, card update forms, and paywalls.

Source: Baremetrics

Baremetrics Recover is Baremetrics' native dunning and failed payment recovery tool that businesses use to recover lost revenue. Because it's part of the broader Baremetrics platform, Recover connects payment recovery directly to MRR, churn, and LTV.

Key Features

- Multi-channel dunning workflows that incorporate email, in-app messaging, and paywalls

- Pre-built recovery campaigns designed around common failure scenarios

- Optimized credit card update forms hosted by Baremetrics

- Recovery performance analytics

- Minimal setup with no development knowledge required

Pros

- Accurate, up-to-date reporting without manual spreadsheet work

- Clear visibility into key KPIs such as MRR, LTV, ASP, churn, and sign-ups

- Reliable, easy-to-use product

- Supportive and responsive team during onboarding and usage

Cons

- For very early-stage startups with low MRR, the cost might not be justified

G2 Rating

⭐4.6 out of 5 (Baremetrics Rating)

Pricing

After the free trial, pricing is calculated based on your actual monthly recurring revenue. For example, a business with $300,000 in MRR would typically pay $499 per month for Recover.

7. Stripe Smart Retries

Best For: Businesses already using Stripe that want basic, automated retry logic for failed payments without adding another dunning platform.

Source: Stripe

Stripe Smart Retries is Stripe's native retry mechanism designed to improve payment success rates for recurring charges. It automatically retries failed payments based on network data and historical patterns across Stripe's environment.

It's built directly into Stripe Billing, so it works best for teams that prioritize native integration and prefer simple setups.

Key Features

- Automated retry scheduling optimized using Stripe network data

- Retry timing based on issuer behavior and historical success rates

- Native integration with Stripe Billing and subscriptions

- No additional configuration or third-party tools required

- Works globally across supported cards and payment methods

Pros

- Recovers significant revenue from failed subscription payments

- Reduces involuntary churn caused by missed or declined payments

- Uses machine learning to retry payments at optimal times

- Improves success rates compared to static retry schedules

Cons

- Not a complete dunning or recovery solution

G2 Rating

Stripe Smart Retries does not have a standalone G2 listing, as it's a native feature within Stripe Billing. Stripe Rating: 5/5

Pricing

Stripe Smart Retries is included with Stripe Billing and does not have a separate line-item price. Stripe Billing offers these pricing models:

- Pay-as-you-go: You pay a percentage of your billing volume, typically around 0.7%, with no fixed monthly fees.

- Monthly subscription (volume-based): Stripe also offers an annual contract paid monthly, starting at around $620/month for businesses billing up to $100,000 per month

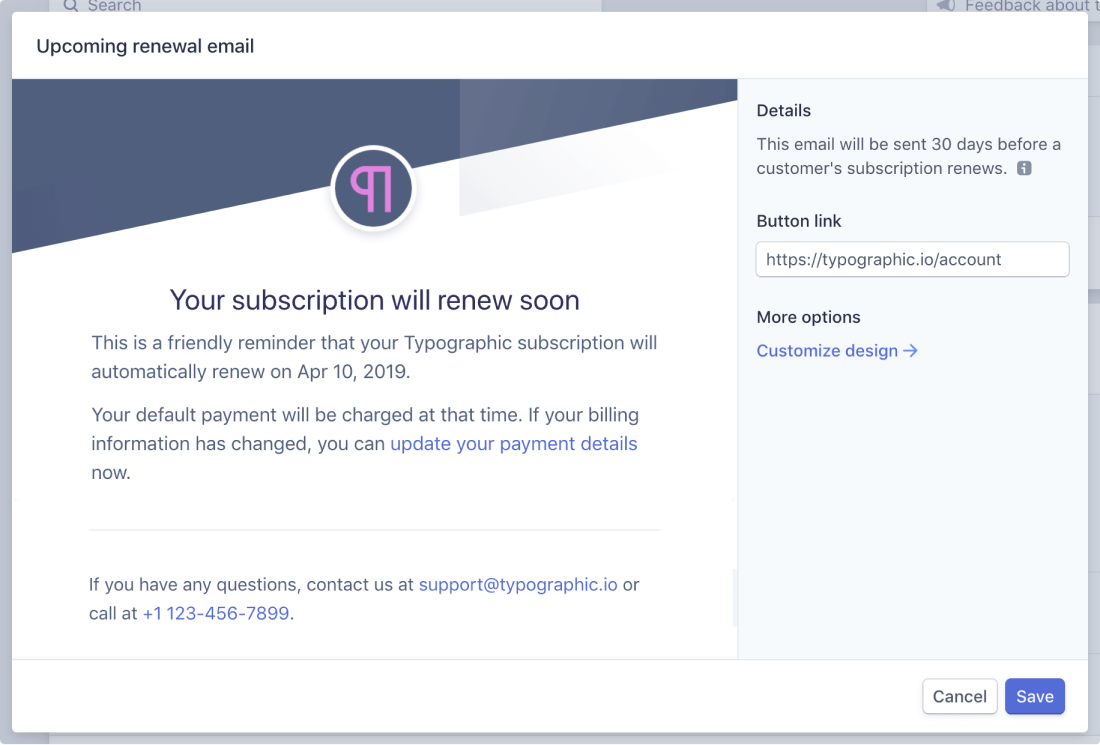

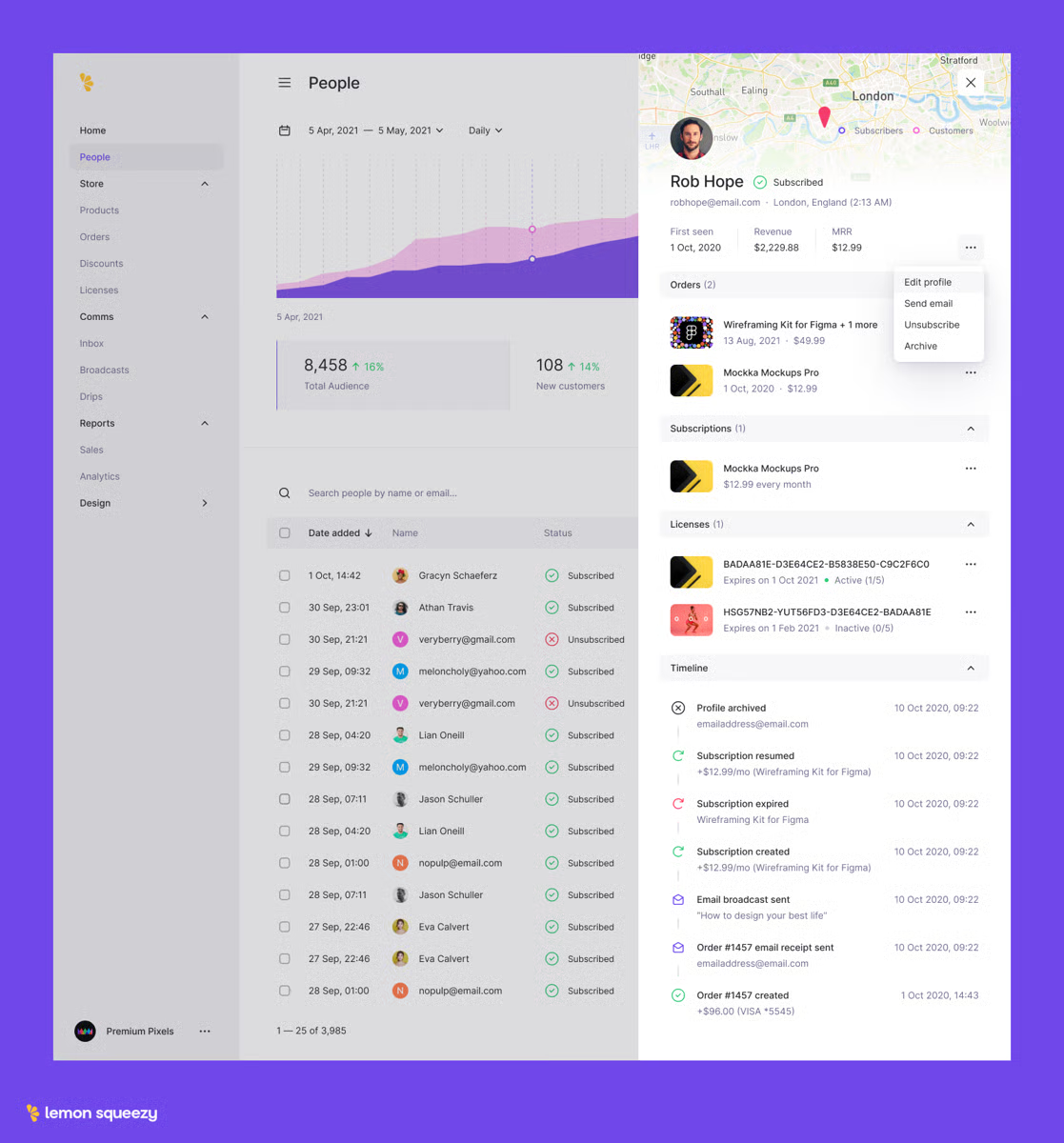

8. Lemon Squeezy

Best For: Creators, SaaS founders, and small-to-mid software companies that prefer dunning, payment subscriptions, and tax compliance in one setup.

Source: G2

Lemon Squeezy includes native recovery and dunning features designed to help businesses recover lost revenue from subscription payment failures and abandoned carts, without requiring third-party tools or add-ons.

Dunning is treated as part of a broader revenue cycle, with failed payments, reminder emails, and hosted payment updates all designed to recover revenue.

Key Features

- Powerful dunning management to combat involuntary churn

- Renewal reminder emails sent before subscription renewals

- Hosted checkout and checkout overlays with no-code setup options

- Customizable dunning emails

Pros

- All-in-one platform for your SaaS business needs

- Recovery and dunning features are included for free

- User-friendly interface and simple to use

Cons

- Customers report slow response times

- Broken checkout issues that can drag on for days

G2 Rating

N/A

Pricing

Lemon Squeezy's recovery and dunning features are included for free as part of the platform.

9. Recurly Dunning

Best For: Mid-market to large subscription-based businesses that need configurable dunning tightly integrated with a mature subscription billing platform.

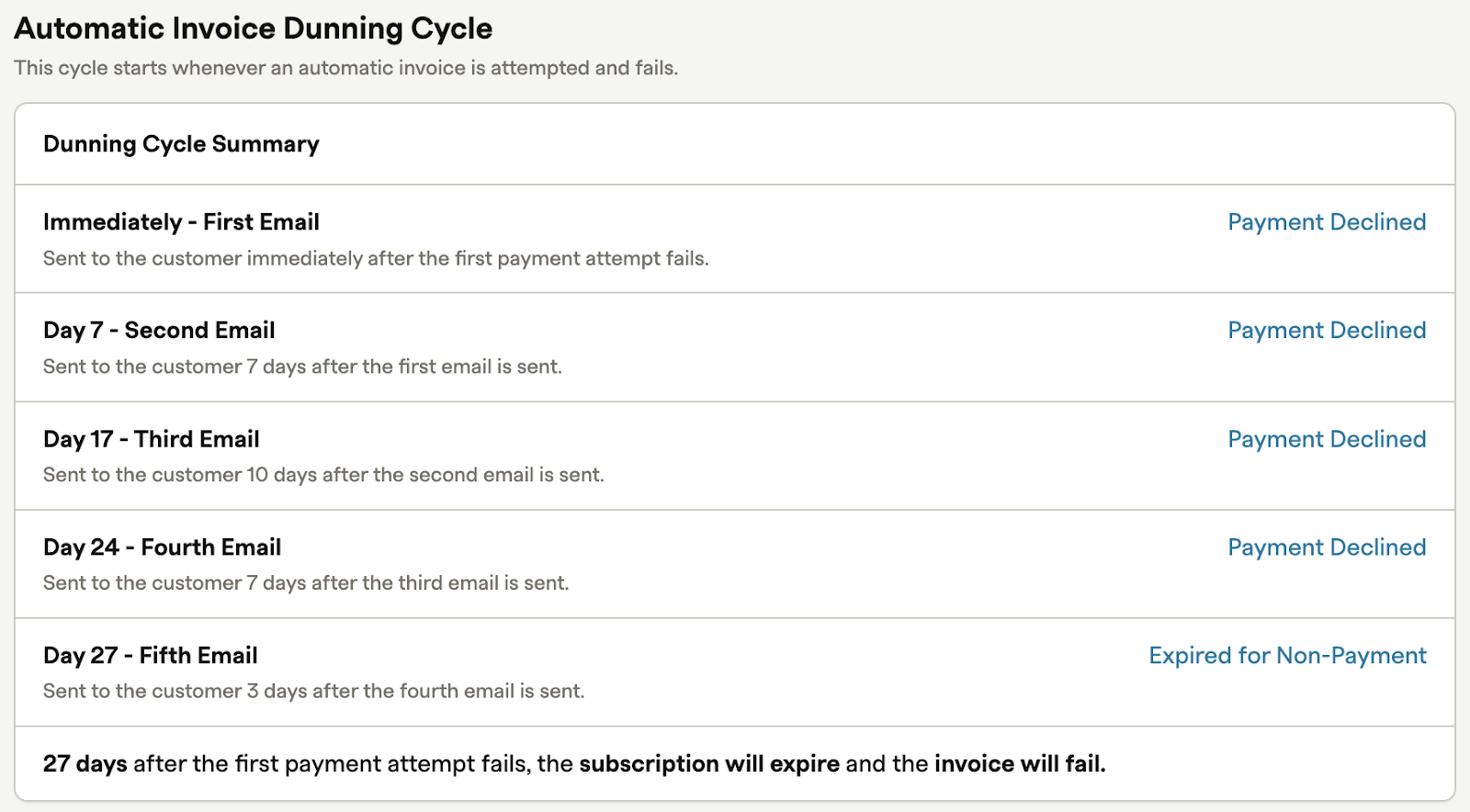

Source: Dunning campaigns

Recurly Dunning is part of Recurly's broader subscription management suite, designed for businesses that need full control over recurring payments, failed payment recovery, and churn management.

This makes it a strong fit for mid-market and enterprise subscriptions that already rely on Recurly for billing and need native, rules-based dunning.

Key Features

- Support for multiple dunning campaigns

- Account Updater and expired card management

- Customizable dunning email templates

- Full subscription lifecycle management

- Support for multiple payment methods

Pros

- Reliable and well-structured subscription management system that simplifies recurring billing

- Intuitive interface that makes it easy to manage all processes from a single view

- Onboarding and setup are generally described as smooth

- Customer support is responsive and proactive

Cons

- Reporting and analytics can feel complex. Some users note that basic or acquisition-related reports are difficult to access or missing

- Third-party integrations can become difficult to manage if not implemented carefully

- Key costs and thresholds should be more transparent

G2 Rating

Recurly does not list dunning as a standalone product, but the platform itself is rated:

⭐ 4 out of 5

Pricing

Recurly's dunning management feature is included as part of its general subscription management platform, which uses a tiered pricing model.

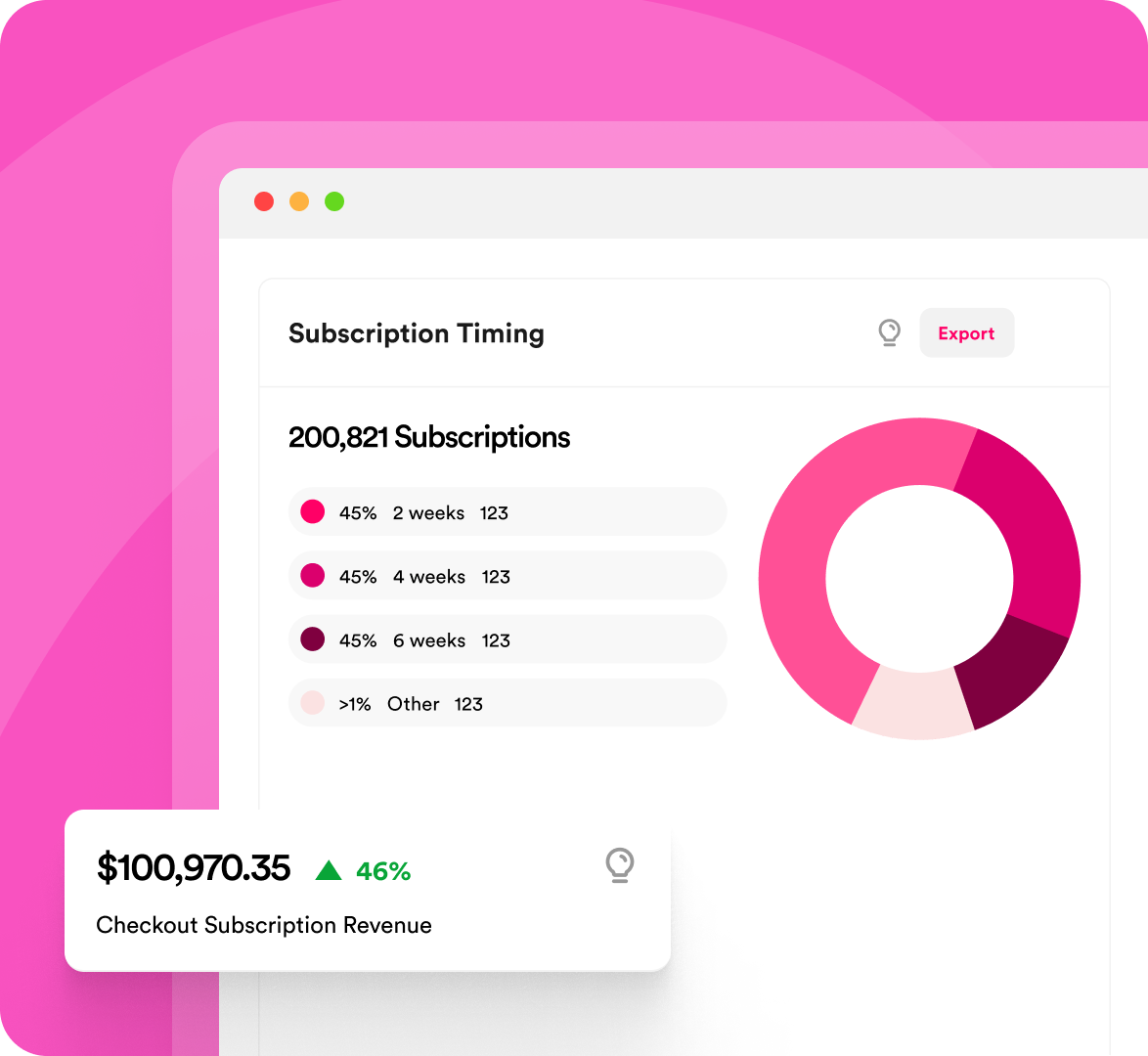

10. Loop Subscriptions

Best For: Shopify subscription brands that want strong dunning and hands-on support to scale recurring revenue

Source: G2

Loop Subscriptions is a subscription management platform built for scaling e-commerce brands, offering smart dunning, personalized retention journeys, and deep Shopify integration.

The platform positions itself as a full subscriber growth system, backed by dedicated success managers and white-glove migration.

Key Features

- Trusted by over 1,065 brands that migrated to Loop

- Built-in smart dunning with intelligent retry logic

- Personalized cancellation and retention flows

- Bulk actions and automated workflows for large subscriber bases

- Flexible billing cycles, discounts, and promotions

- Deep Shopify integration with inventory forecasting

Pros

- 40% lower costs than some competitors

- Simple, flexible, and feature-rich UI

- Great for small businesses trying to cut costs without compromising on subscription services

- Smooth and reliable migration from other subscription platforms

- Exceptional customer support

- Valuable analytics for data-driven subscription decisions

Cons

- API is still evolving, and not all features available through the web interface are accessible via the API yet

G2 Rating

⭐ 4.9 out of 5

(⭐ 5.0-star reviews on Shopify App Store)

Pricing

Starts at $99/month, with the Pro plan costing $399/month and custom pricing available upon request for Enterprises.

11. Stay AI

Best For: SaaS and subscription businesses that want AI-driven churn prevention and dunning automation integrated into customer touchpoints.

Trusted by top Shopify brands, Stay AI helps you scale subscriptions by turning them into a growth channel, with proprietary machine learning and reinforcement models.

Teams appreciate the platform's cutting-edge solutions for business operations and the intuitive dashboard, which contributes to a smoother overall experience.

Source: Stay AI

Key Features

- Trusted by top Shopify brands

- AI-driven failed payment recovery logic

- In-app and email engagement workflows

- Cancellation flows with incentive offers

- Integrates directly with Shopify plus over 100 other tech solutions

Pros

- Great line of communication from their team

- Intuitive and user-friendly platform

- Advanced analytics that provide in-depth insights

- Top-notch features that support business operations

Cons

- Dashboards may slow down when working with large datasets or complex automations

- Understanding advanced conditional logic or syncing every touchpoint with Shopify Flow may require a learning curve

Rating

⭐ 5 out of 5

Pricing

Pro Plan is at $499/month, and Enterprise is custom-based.

Which is the Right Dunning Management Software Tool For You

The right dunning management software for you depends on your business focus and which platform best matches that. To summarize:

- If you're a B2B business dealing with invoices, overdue balances, and fragmented AR workflows, tools like Lunos AI are built to help you scale.

- If you run a SaaS or subscription business and need dunning plus cancellations handled together, look at Paddle Retain, Chargebee Retention, or Recurly Dunning.

- Stripe-native businesses often prefer Stripe Smart Retries, and Baremetrics Recover also works well for Stripe customers.

- For Shopify subscription brands, platforms like Loop Subscriptions and Stay AI are top-rated.

- Other popular subscription-first recovery tools to consider include Churn Buster and Lemon Squeezy.

Ready to automate your accounts receivable and recover more revenue? Start for free with Lunos AI and see how an AI coworker can reduce your AR workload by 75%.