The 7 Best Growfin Alternatives for Smarter AR Automation

Growfin is a feature-rich AR automation software, but not every finance team considers it a perfect fit. If you're looking for a cheaper, more intuitive, or more personalized solution, this guide is for you. Here, we'll break down the 7 best Growfin alternatives and the kind of finance teams each serves best.

Quick Summary

Growfin is a feature-rich AR automation software, but not every finance team considers it a perfect fit. If you're looking for a cheaper, more intuitive, or more personalized solution, this guide is for you. Here, we'll break down the 7 best Growfin alternatives and the kind of finance teams each serves best.

Here are our top three picks:

Considering a Growfin Alternative?

Growfin is a solid accounts receivable (AR) automation software for finance teams looking to systematize their AR collections and take manual follow-ups and repetitive messaging off their desks.

Growfin has many helpful features, like its deep integration with NetSuite, payment delay predictions, and cash flow forecasting. However, it also has a few limitations that have prompted many users to look for alternatives:

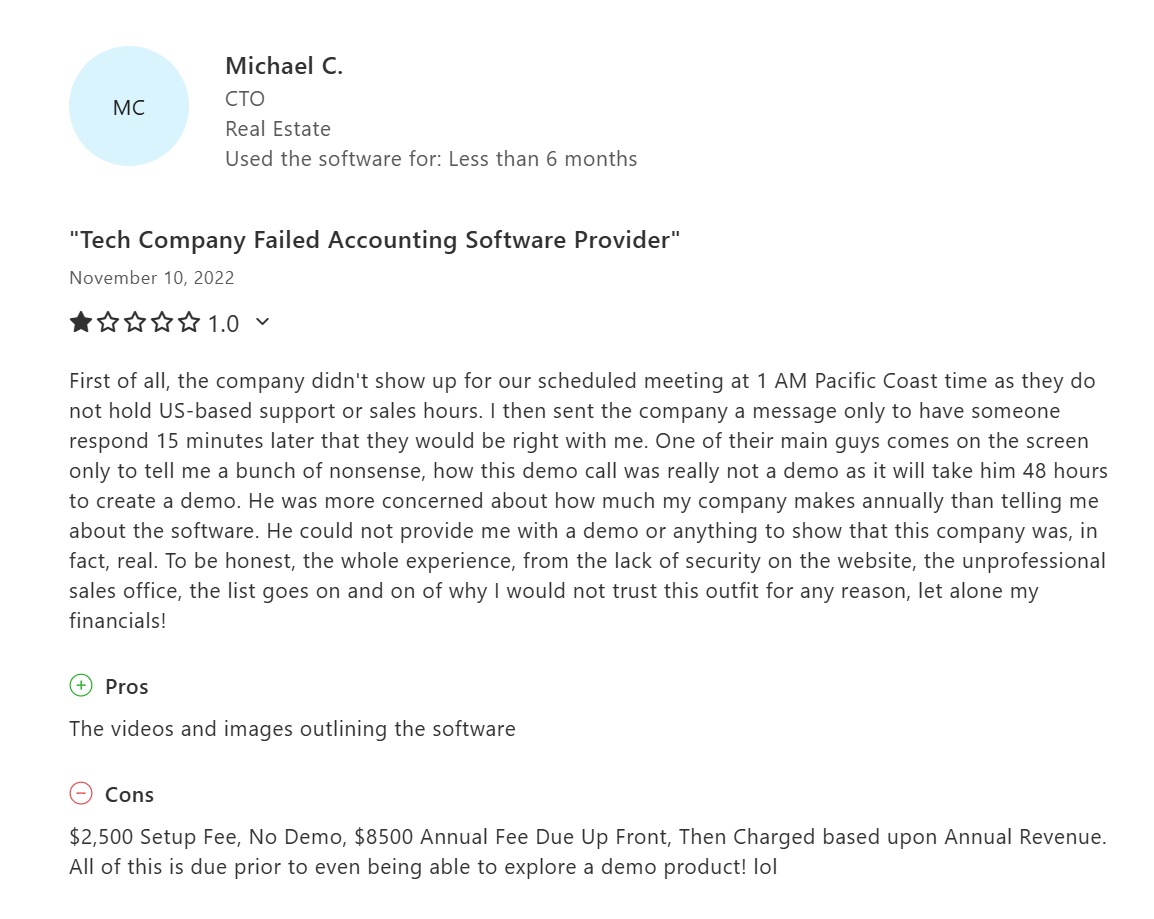

1. It Can Be Pricey for Small Businesses

Growfin is built for enterprise brands with large, complex AR backlogs. Its platform is heavily ERP/NetSuite based, and its pricing reflects this.

According to a Capterra review, Growfin charges "$2,500 Setup Fee And $8500 Annual Fee Due Up Front, Then Charged based upon Annual Revenue."

If your brand is small or mid-market, this pricing is steep and might be too expensive.

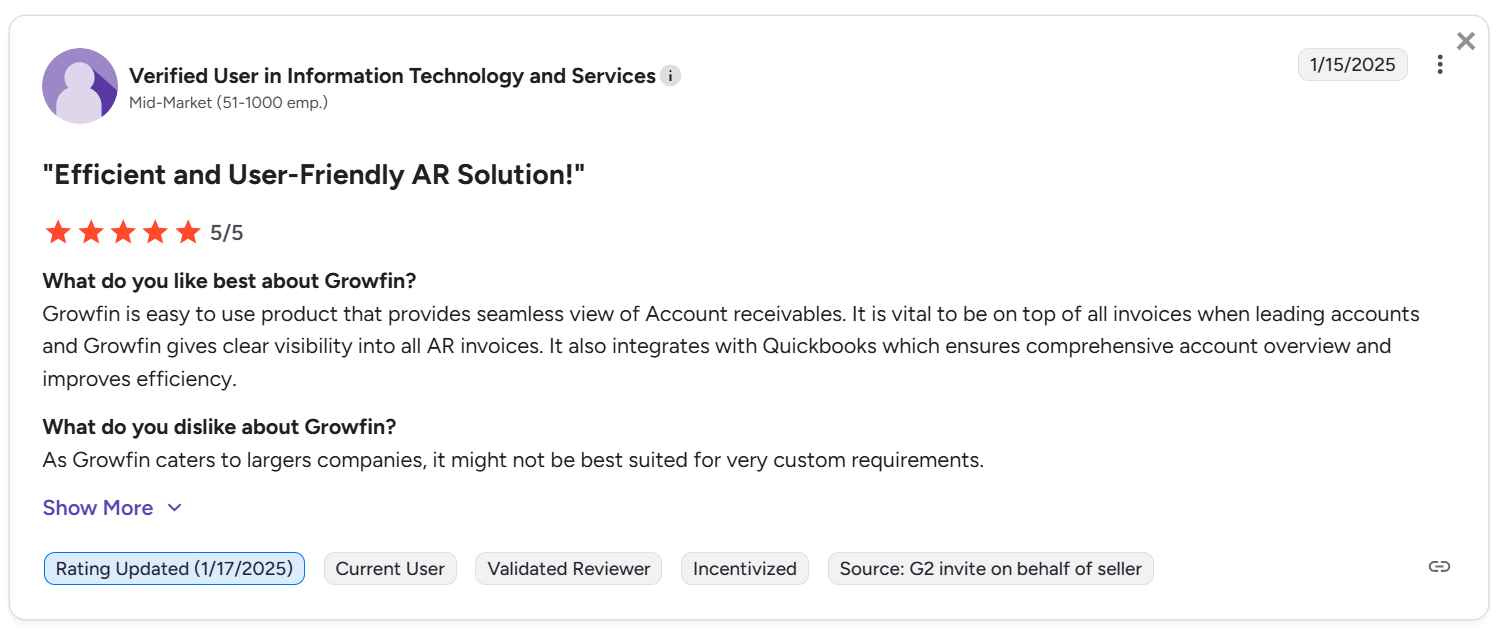

2. It Isn't a "Full Digital Worker"

Growfin is strong in forecasting, prioritization and follow-up automation, but since it uses the same rigid automation rules for each account, it lacks the nuance that shifts AR collections from a chase into a conversation.

As one G2 reviewer said, "it might not be best suited for very custom requirements."

This means that while you can use Growfin to fire off rule-based reminders, it falls flat when you need to customize your messaging or collection approach. If your process requires nuance, you may need a tool that's more adaptable.

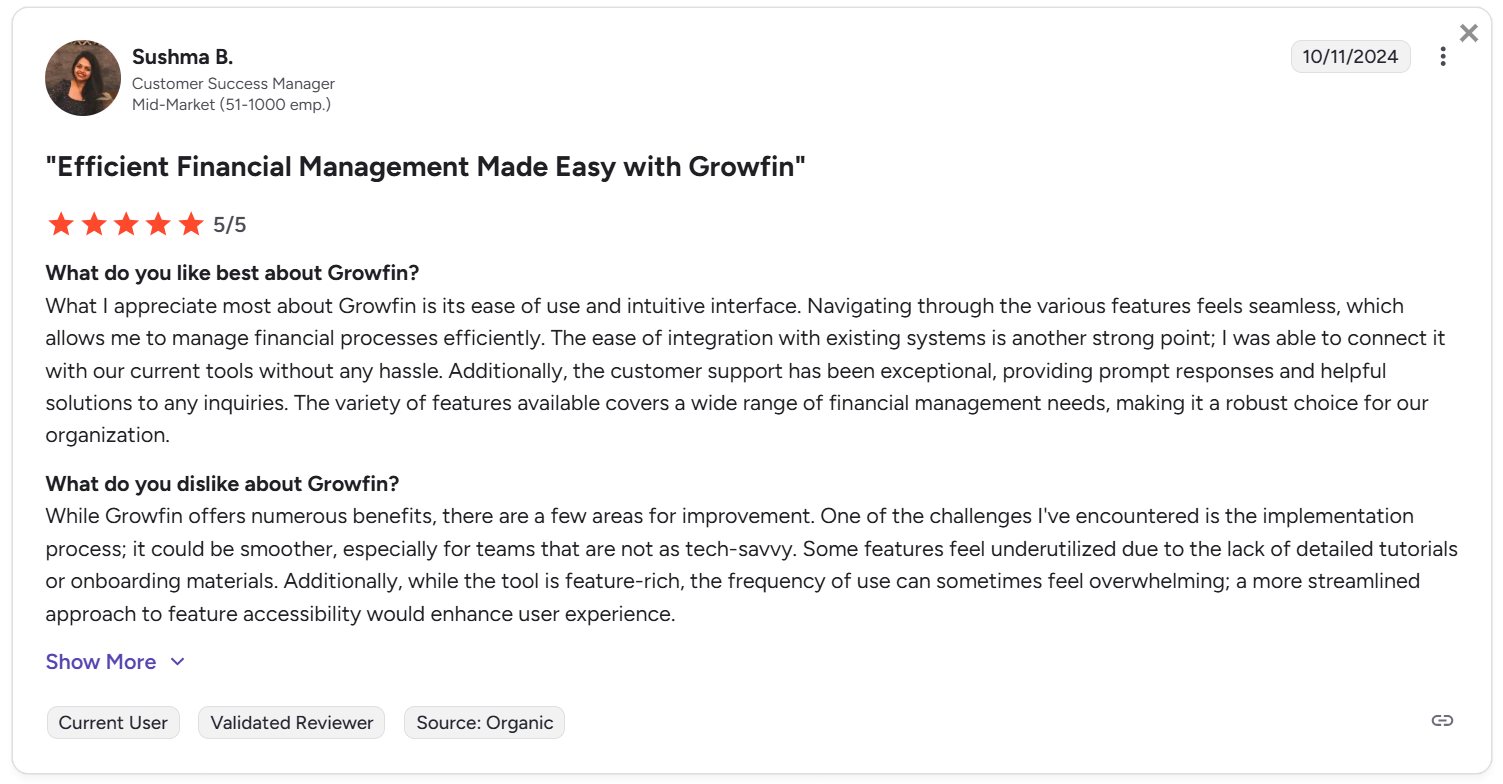

3. It Has a Steep Learning Curve

Growfin is a powerful tool with many unique features, but it takes some focused time to get the hang of and really maximize it.

If you or your team isn't finance savvy, Growfin might seem technical and hard to grasp like it was for this user who shared that "One of the challenges I've encountered is the implementation process; it could be smoother, especially for teams that are not as tech-savvy. Some features feel underutilized due to the lack of detailed tutorials or onboarding materials."

Why Trust This Review?

Our team at Lunos has more than 2 decades of combined experience in the finance and payments industry, having worked with brands like GoCardless, Plastiq and CapChase.

These valuable firsthand experiences helped us build Lunos, our first-of-its-kind AI coworker for accounts receivable. As we spend our days fine-tuning and perfecting Lunos for our customers, we have gained (and continue to gain) valuable insight into the challenges users face with other tools in the AR space (like Growfin).

This review is based on those insights as well as some novel features Lunos offers but Growfin doesn't.

The 7 Best Growfin Alternatives to Consider in 2026

Here are the 7 best Growfin alternatives. We'll share what makes each different and what each is best for.

In a rush? Here's a comparison table for an at-a-glance look.

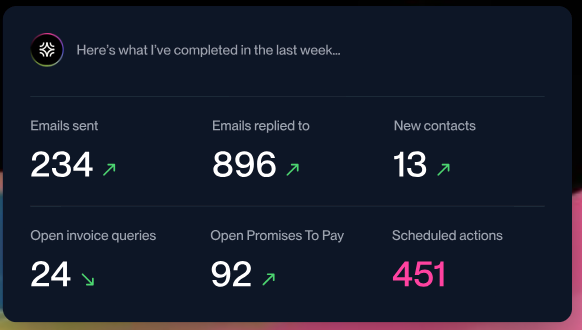

1. Lunos

Best for: Teams that want more nuanced, personalized AR automation

Lunos takes traditional AR automation a step further by introducing features that allow finance teams to treat each collection as a unique event. Instead of a collection process that follows hard and fast rules or rigid categorizations to set and send reminders, Lunos's AI:

- Brings all customer data from ERP, CRM, email, and payment systems into one central place

- Reads and understands customer communications about payment in real time

- Tracks customer payment behavior and relationship history

- Uses all this data to build a customized payment collection process for each customer, adjusted for tone and timing

- Understands customer intent (e.g., "we'll pay next week") and adjusts collection process and follow-ups automatically based on context

This level of personalization brings humanity and nuance into your financial operations and helps you preserve customer relationships, all while enjoying every benefit of traditional AR automation software: reduced AR workload, significant DSO reduction and reliable cash forecasting.

Key Features

- Brings all ERP, CRM, email, and payment systems data into one place. No more copying data scattered across email threads, ERPs, and spreadsheets.

- Handles two-way email communications. No more losing important payment information in long email threads.

- Creates personalized messages (and collection plans) based on contextual customer data. No more templatized follow-up messages to hundreds of customers.

- Automatically adjusts collection plans based on customer replies. No more being stuck with an automation tool that can't handle replies and still requires manual responses.

- Monitor, Suggest, and Act modes to control how much independence the AI has. Your team stays in control at all times.

- Uses Slack to communicate with you. Zero learning curve necessary.

- Keeps a perfect log of every outreach, response, and promise. So you can track Lunos' compliance and monitor your collections process.

- Automatically routes complex situations to your team. Lunos will contact your team instead of glitching if a customer replies with "We're not paying this invoice. The contract says quarterly billing, not monthly, and your sales rep approved a discount that's missing here."

Better Than Growfin If

- Your follow-up messages don't land with customers because they are too generic or templatized

- You're tired of automation tools that stumble when managing replies

- Your small team needs a tool that can grow with it

- You want a tool with zero learning curve

Pricing

Lunos has three plans, allowing it to scale with you as your business grows:

- Starter (No monthly fee but 0.3% charge on all collected revenue): Ideal for small teams new to AI for accounts receivables. Allows just 3 users.

- Pro ($200/month PLUS 0.3% charge on all collected revenue): Ideal for growing finance teams who want more control and hands-on support. Allows unlimited users.

- Enterprise (Custom pricing): Best for enterprise brands with complex AR needs. Allows multiple users and comes with white glove onboarding.

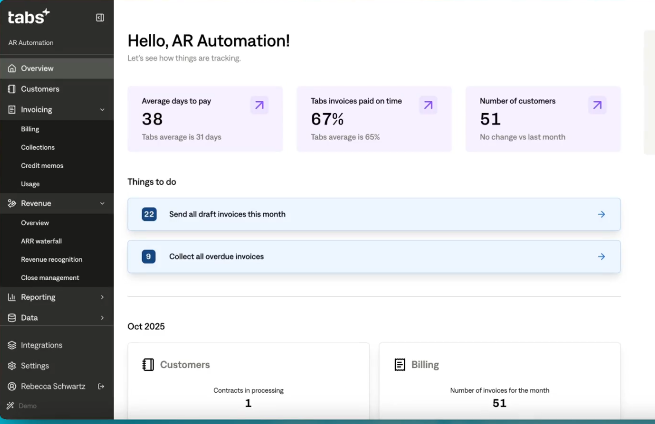

2. Tabs

Best for: Teams that use different billing models and want to centralize invoice generation, collections, and revenue intelligence

Tabs lets B2B finance teams go from contract to cash to financial reporting without manual tracking and pricing model chaos. Tabs takes all your contracts—whether the customer is using a usage-based, hybrid, milestone or subscription-based pricing model—and automatically generates accurate invoices for every account.

Tabs then automates the collection lifecycle, tracking invoice status, sending follow-ups, and updating invoices when contracts change. With the usage data Tabs generates, it also automatically creates compliant revenue schedules and provides consolidated reporting on cash, deferred revenue, ARR/MRR, etc.

Key Features

- Powerful AI agents that extract contract terms and automatically generate invoices

- Ability to read and understand all kinds of pricing models

- Real-time visibility into revenue status and compliance

- Collections automation, with tracking and follow-ups

Better Than Growfin If

- You want a tool that can generate its own invoices, not rely on existing invoices from ERP

- You want a single platform that replaces multiple tools (billing, collections, revenue recognition)

- You want an AR automation software with revenue compliance baked in

- Your B2B brand uses multiple pricing models

Pricing

Tabs has 4 plans:

- Launch ($1.5K/month)

- Growth (custom)

- Scale (custom)

- Enterprise (custom)

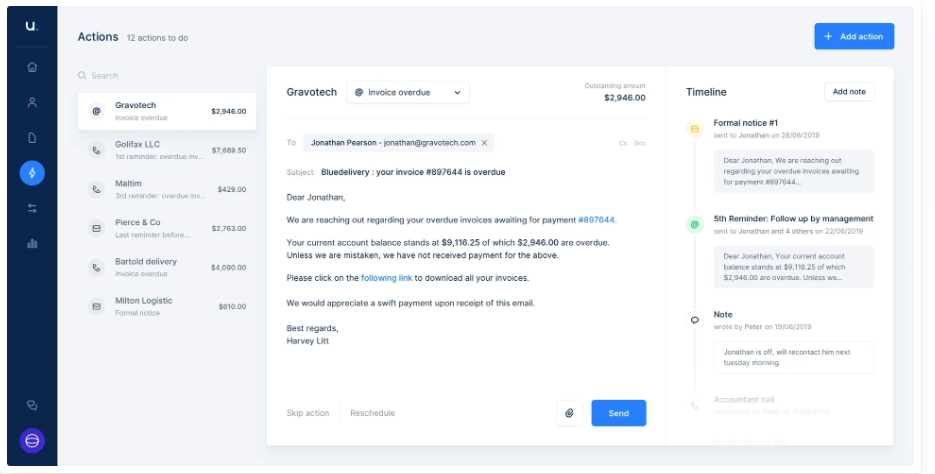

3. Upflow

Best for: Teams that want to turn every payment collection into a positive customer experience

Upflow treats every financial touchpoint as an opportunity to nurture and strengthen customer relationships. Instead of firing off basic reminders, Upflow creates a payment portal for each customer where they can view their invoices, balances and different payment options. Each customer portal also comes with a communication channel to ask questions and resolve conflicts.

Upflow also has workflows and Smart Rules features for personalizing each reminder for tone, medium and frequency. This unique setup ensures that every customer receives a personalized, one-to-one payment experience, contributing to customer trust and retention.

Key Features

- Collection workflows to run personalized collection campaigns adapted to customer type, payment behavior, invoice age, risk profile, geography, etc.

- Flexible payment options like partial payments, Autopay, or early payment discounts

- Personalized reminders via email, SMS and calls

- Individual self-service payment portals

Better Than Growfin If

- You want your finance team to contribute to customer retention

- Your finance teams manage customers with long, complex sales cycles

- Your reminders don't land with customers because they are generic

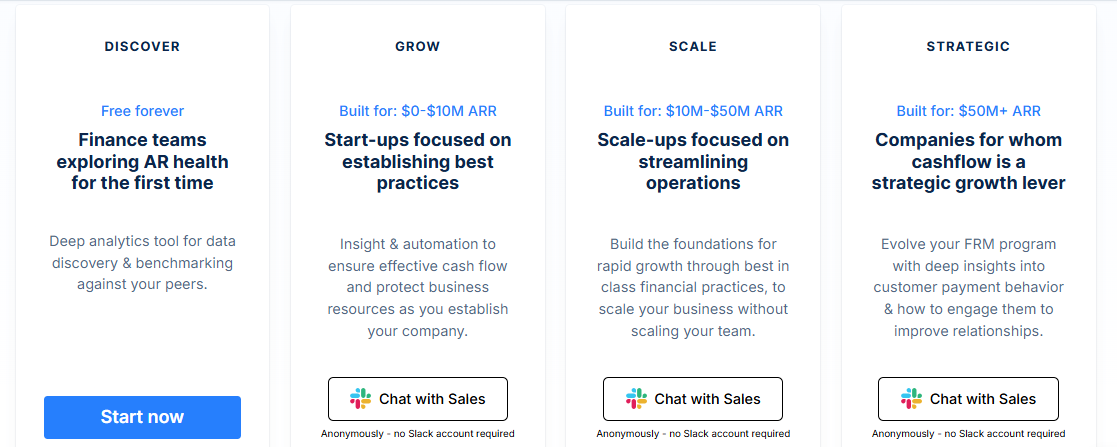

Pricing

Upflow has 4 plans built for businesses at different growth stages. The first plan is forever free while the remaining 3 plans are priced according to your custom needs.

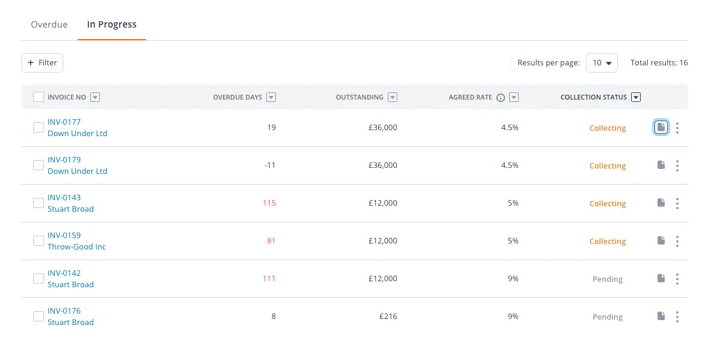

4. Chaser

Best for: Teams that want a tool that combines simple AR automation with simple personalization

Chaser simplifies AR automation for teams that just want to get their cash as fast as possible, without manual monitoring and payment tracking across multiple tools and with minimal personalization.

Chaser does this by:

- Quickly identifying risky accounts you must act on (credit monitoring, payer rating, late payment prediction)

- Incentivizing customers to pay early (early payment discounts, late payment fees)

- Automating collections (customer payment portal, payment reminders via email, SMS and calls, AI email generator)

- Using ChaserPay to create payment links embeddable into reminder messages, making payments faster and easier

- Creating slightly personalized reminder messages using its AI (messages have your branding, signoff, etc.)

Chaser also uses its usage data to accurately forecast your receivables, cash flow and revenue, so you can have a clear idea of where your cash lies.

Key Features

- ChaserPay for one-click payments via multiple payment routes (ApplePay, credit cards, etc.)

- Customer payment portal to prompt self-serve payments

- Accurate prediction of defaulting and risky accounts

- Early payment prompting

- Multi-channel reminders

- Branded messages

Better Than Growfin If

- Your customers don't mind reminder messages that are not very contextual

- You want to acquire as much payment as possible within a short period

- You want to integrate multiple payment options

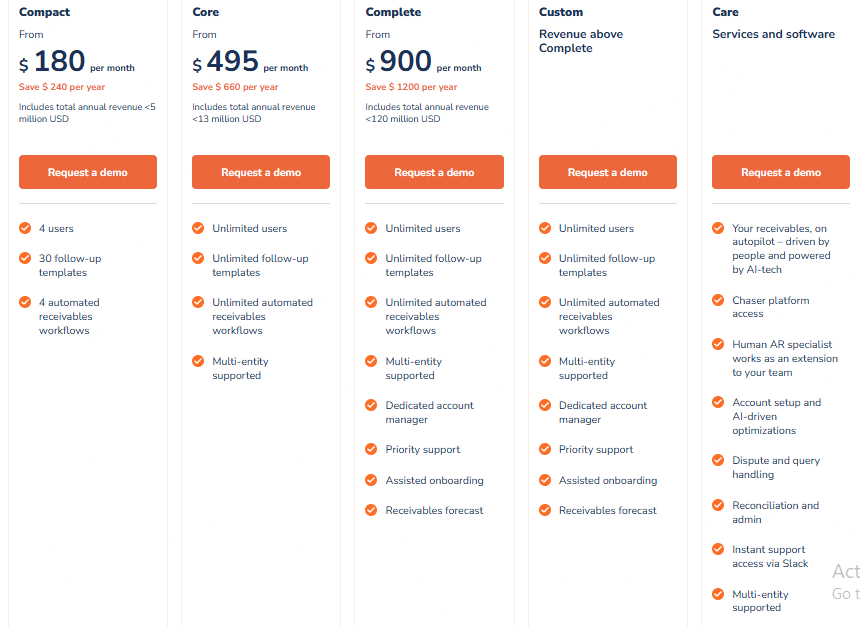

Pricing

Chaser has 4 plans based on your brand's total annual revenue. It also has a separate "Care" plan if you want a human AR specialist to handle your Chaser account.

Here is how much each plan costs:

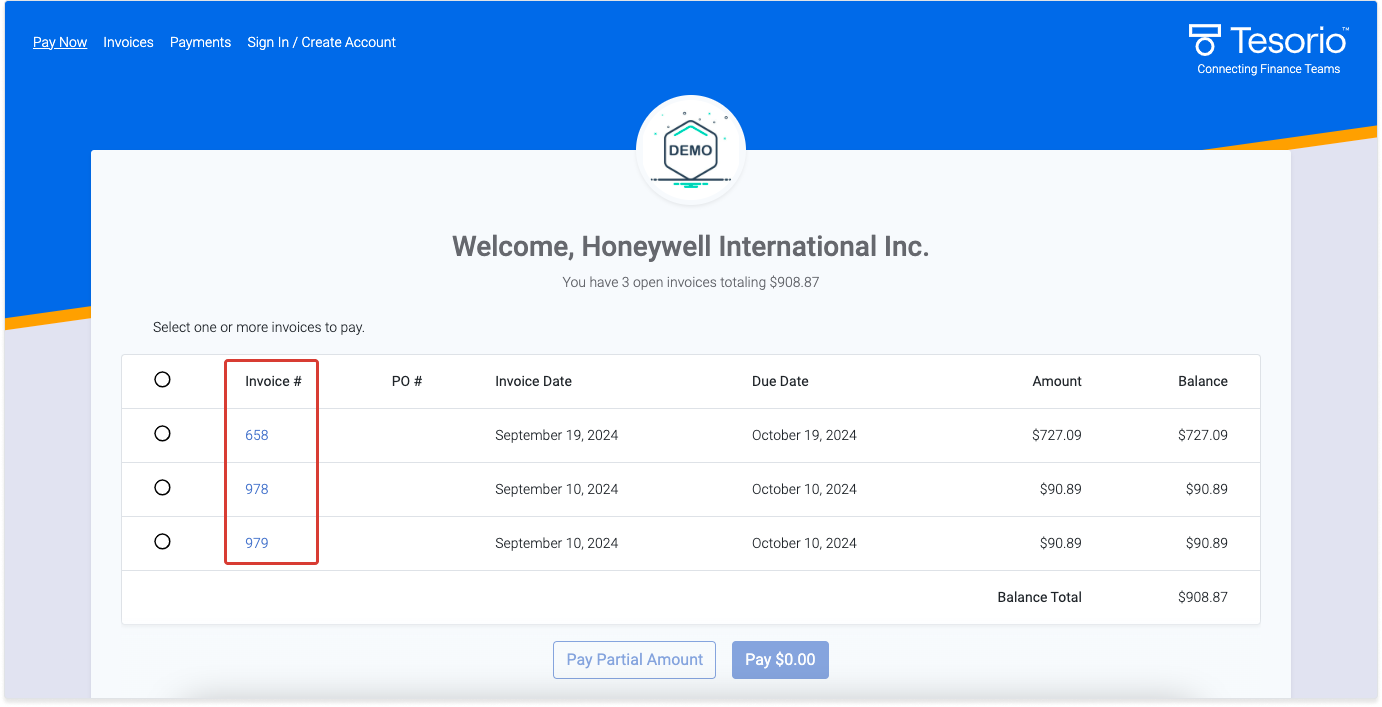

5. Tesorio

Best for: Mid-market or enterprise level finance teams that want an intuitive tool that can handle complex AR operations and that has strong cash flow forecasting

Tesorio not only automates AR collections but also helps large (mid-market or enterprise level) finance teams make very accurate cash flow forecasting using predictive analysis. Tesorio uses historic data and machine learning to detect when customers are likely to pay and what cash flow will look like over time. This means you can approach financial planning proactively, not reactively.

Tesorio also has an intuitive, easy-to-use interface as well as advanced features that make its function extend beyond firing off basic reminders.

Key Features

- Strong cash flow forecasting based on machine learning

- Built for large finance teams with high-volume, complex AR operations

- Has cash collection campaigns and workflows to segment and personalize reminders

- Advanced features like cash collection scores and cash application agent/payment matching

Better Than Growfin If

- You need very accurate revenue forecasting

- You care about unified AR and cash flow visibility

- You want a tool that's easier to use with little to no learning curve

Pricing

Tesorio is a premium software with plans reportedly costing as much as $30k/year for a baseline automation package. You'll need to contact Tesorio's sales team to get precise pricing for your specific needs.

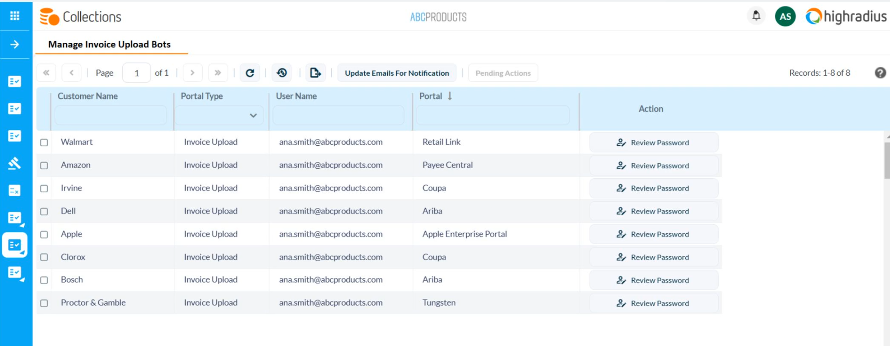

6. HighRadius

Best for: Mid-market to enterprise teams that want one platform that handles the entire order-to-cash lifecycle PLUS credit/risk assessment

HighRadius brings intentional credit assessment and risk analysis into the AR automation world. Rather than assigning customers a risk score based only on their payment history with your brand, HighRadius integrates with credible credit agencies to get a deeper understanding of each customer's payment habits across multiple business partners.

HighRadius also doesn't just automate collections. It handles finance operations from when an order is made to when cash is received. This includes invoice gathering, collections prioritization, automated reminders, cash application automation, dispute management, and cash forecasting.

Key Features

- Detailed credit history and risk assessment

- Comprehensive order-to-cash management

- E-invoicing portal for invoice gathering and sorting

- AR collections automation including payment matching and dispute management

Better Than Growfin If

- You want one platform for all financial ops from order to cash

- Your team handles complex credit and risk profiles

- You want enterprise-level analytics and AI cash flow forecasting

Pricing

HighRadius uses a subscription-based pricing model that's not available online. However, marketplace reviews claim that the tool has good value for money.

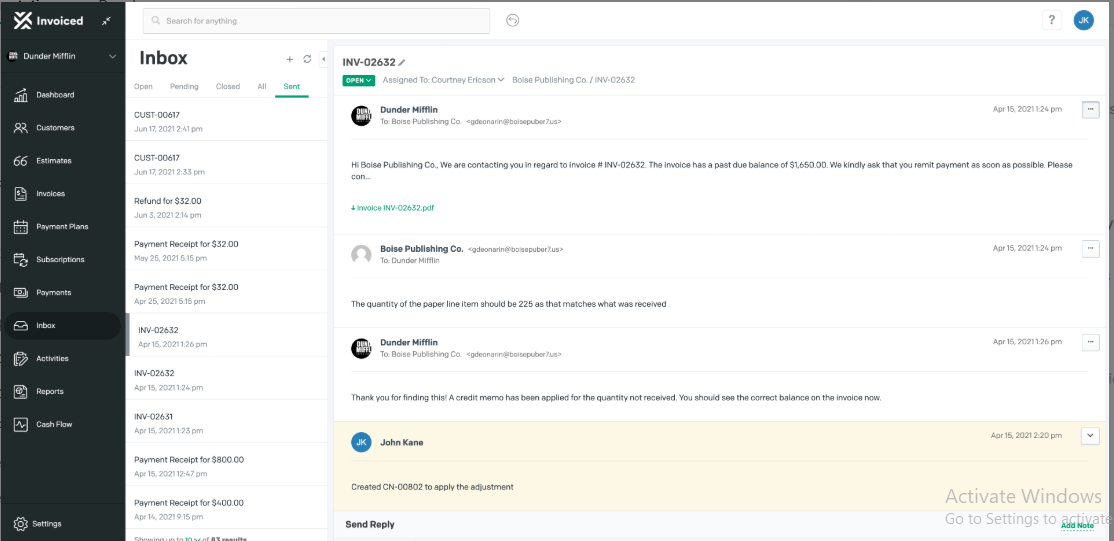

7. Invoiced

Best for: Teams that want a very simple invoice-to-cash AR automation software

Invoiced automates the entire AR operation from invoicing to payments to cash application using features like invoicing workflows, smart payment chasing, self-serve customer portal, and automation builder.

Invoiced also has:

- A payments feature that allows your B2B customers to pay via different routes like ACH, BACS, direct debit, credit cards, iDeal, SEPA, etc.

- An analytics feature for revenue reporting and cash flow forecasting

With its simple, intuitive user interface, Invoiced is easy to jump into and start using even if your team isn't tech savvy.

Key Features

- Complete invoice-to-cash AR automation

- Multiple payment options for your B2B customers

- AR collections automation

Better Than Growfin If

- You want a really simple tool with zero learning curve

- Your customers will benefit from different payment routes

- You want to automate not just collections, but invoicing and cash applications

Pricing

Invoiced issues custom pricing per user after you book a demo with their sales team. However, online reviews point to the software being on the expensive side.

Choose the Perfect Growfin Alternative

An AR automation tool that satisfies every finance team might not exist, but the perfect tool for your AR needs probably does. The key to finding it is being very clear about what you're looking for.

Note down exactly why you're switching from Growfin—or considering alternatives—then study this guide to find that one tool that solves that exact problem.

Whether that is Lunos that digests multi-channel customer data and creates a custom collection plan for each of your customers, or HighRadius that combines detailed risk assessment with AR automation, the choice is yours.

Ready to see how personalized AR automation works? Start for free with Lunos and experience collections that feel human, not robotic.